The very first step in starting a small business or any business for that matter is creating a business plan. A business plan is a solid, realistic plan for your business idea. It’s imperative to your success as a new business owner. It will provide you with a guide on how you will operate your business for the first 6 – 12 months at the very least.

How long should I take to create my plan?

Before you make any plans to open your business, take some time to create your business plan. Creating your business plan should take you anywhere from 3 to 12months. This is completely dependent on the type of business you want to open, the formality of your plan, and how in depth you decide to make your plan. It is also dependent on your own personal time frame.

When I created my own business plan for my small home Massage Therapy & Aesthetics business, I spent a few years on it. This is mainly because I had 3 jobs and minimal time to do my planning. I also knew that I wouldn’t be opening my business for a few years as I had made a decision to move to a different city before opening my business. This is helped to determine my time frame.

Knowing that I had ample time, I decided that I wanted to create a comprehensive, yet informal plan for myself so that I would know how to operate my business and deal with different situations once I opened it to the public. This was especially important for me since I was also moving into a new house in a completely different city 3 hours away from where I was currently living. Having a comprehensive business plan took care of a lot of different aspects of my business that would have put extra stress on me had I not them as part of my plan.

It also allowed me to focus more on my clients and worry less about protocols, procedures, income and expense projections, marketing, and advertising. It was all included in my plan. All I had to do was provide quality services to my clients, follow my plan, and make adjustments as needed. Since I was opening my business two and a half months after I moved, I needed my plan to be ready, BEFORE I moved. Your situation may be completely different than mine and because of that, you should make your own informed decision regarding how long you need to write your business plan and how in-depth yours will be.

Is writing a business plan hard?

Creating a business plan is not hard, merely time-consuming. You need to be sure to take the time to do your research and go through each step thoroughly before moving on to the next step. You only need to focus on one step at a time. When going through this process, you may begin to find it overwhelming at some point. When this happens, the best thing to do most of the time is just to take a step back from it for a day or two and then continue.

Do I need a business plan if I don’t need a loan?

If you are funding your business yourself, you should still create a business plan. The plan’s purpose is to provide you with a realistic and specific (yet flexible) path through your first 6 – 12 months, preferably the first 2 years. It contains everything you need to know regarding your business growth and projections, what you’re expected to earn as long as you follow your marketing and advertising plan, policies, and procedures of your business, etc.

It will help you deal with different business situations, help you realize when you are overspending and ultimately, it will help you stay on track while growing your business.

If you are writing the plan for yourself only, you can keep it casual and still create a comprehensive plan for yourself. If you require the financial help of a loan or investor, you will need to have a formal business plan to present when you have your meeting with them.

What is a full vs. basic business plan?

A full business plan is a complete guide to opening and growing your business for the first 6 months to 2 years. It includes almost everything you would need to know to get started, stay on track, and successfully grow over time. A basic business plan would include just enough information to get your business open and growing for the first 6 – 12 months. A basic business plan is not comprehensive and you will update a lot as you go.

I highly recommend writing a comprehensive plan for yourself so that all the work is done in advance and you can focus on business growth after you open your business. The last thing you need when opening a new business is to be worrying that you forgot things which leads to constant updates made to your plan. This is not necessarily a bad thing, however, YOU are the person who will be spending the time to make each update.

If the work is done in advance, minimal updates will be required. Sometimes, you can even go a few months between adding things to your plan. They should only be needed when part of your plan isn’t working or you experience a situation that you didn’t expect at which point, you would develop a protocol for it and update your plan with the new information.

Need extra guidance & support? Join our Facebook group! CLICK HERE TO JOIN!

What makes a great business plan?

An excellent business plan will include all of the necessary plan aspects including income/expense projections, full budget breakdown with startup cost projections, market research, realistic projections, business procedures & policies, marketing and advertising plan for your first 6 months, and more. It will also be realistic, have a complete analysis of the business you want to open, a complete competitor analysis, and it will work through any projected difficulties you anticipate after opening.

What is included in a business plan?

Market Research

Take some time to research how many similar businesses are already in your area, how many are already established, the population of your area as well as competition services/products, fees, accommodations offered, and anything else you can think of. The research will help you determine if your services are in demand in your area and what type of competition is already out there. Use a notebook and keep all of your research in one place. Market research is where you gather data on your competition and analyze it to help you make informed decisions for your business and help shape your business plan.

Plan purpose

Determine whether the purpose of your business plan is to keep yourself on track or for a bank loan. This will determine how formal your plan should be.

Mission statement

What is your promise to your customers? Why did you create your business? What is your overall goal? What makes you and your business different from every other related business in town?

Executive summary

This is the first thing that anybody will look at if you are using your business plan to apply for any kind of loan. Your executive summary should include:

A complete overview of your plan including your mission and/or vision statements, an outline of your business strategy, and a basic overview of your plans and goals for your business. Also, include a brief background of yourself and a basic overview of your financial status and needs.

Basic timeline/schedule trajectory

Include key business milestones you want to reach and associated deadlines for each.

Competitor Analysis

You can make this step as complicated as you want but at the very minimum, analyze your competitors and what they are doing to get and keep customers. Analyze products, services, and fees and get inside some similar businesses to see how they are treating their customers and how they have their business space set up.

Services/Products & Fees overview

Include the services, products, packages offered and associated fees in your plan.

Budget Breakdown – Start up Costs

You will need to include this step to help keep you on track financially during your start up process so you don’t overspend.

Projected Expenses

This will cover the projected monthly expenses to run your business.

Projected Income Calculations

You will always need to have your projected income calculations based on the realistic amount of services/products you can and will provide and the number of customers you will have monthly.

Quarterly income/expense goals

You will need to include quarterly income/expense goals. These are projections that will help keep you on track and motivated. Also, the bank will also want to see these projections so don’t skip this step!

Day to day operations

Include a basic overview of your day to day operations.

Policies & Procedures

Before opening your business, you will need to brainstorm different scenarios that may occur and decide on policies and procedures so that dealing with these interactions remain professional and consistent with every customer.

Marketing plan

Include an overview of your marketing plan. How will you market your business to potential customers.

Advertising plan

Include an overview of your advertising plan. you should have a plan in place for at least the first 6-12 months.

Personal business goals

-This is something that you may want to include for yourself as a separate part of your plan. You can have goals you’d prefer for your income such as daily and weekly goals for the number of customers or products/services sold. Keep in mind, this will be different from your formal income projections and is not part of your main business plan that you would present to a bank or investor.

SWOT Analysis

This is a strategic analysis of your business’s strengths, weaknesses, opportunities, and threats. Applying this step will help you formulate your business plan and plan for obstacles that may occur. It will also provide you with a realistic look at your overall business idea and if it is even feasible to start this business.

How do you create a business plan?

By following the steps above and moving through each step one at a time, you will create and end up with a thorough business plan for yourself and your new business. Just remember to think through each step, be thoughtful and realistic about your plan. If your plan is just for yourself, you can write it out on paper but if you are presenting it to a bank or investor, you will have to have it typed out on a computer and put in a folder to be presented when you go to meet with your investor.

Do business plans have to have pictures, graphs or charts?

If your plan is just for you, you do not need to include photos. However, if you are presenting your plan in a formal way to an investor, pictures in the form of graphs and charts are a good idea. Just make sure not to overdo it. Use the appropriate photo in the appropriate sections to make your point and then move on. Not every section requires a photo.

What should not be included in a business plan?

- Unrealistic expectations

- Don’t lie in your plan

- Don’t focus too much on the products/services

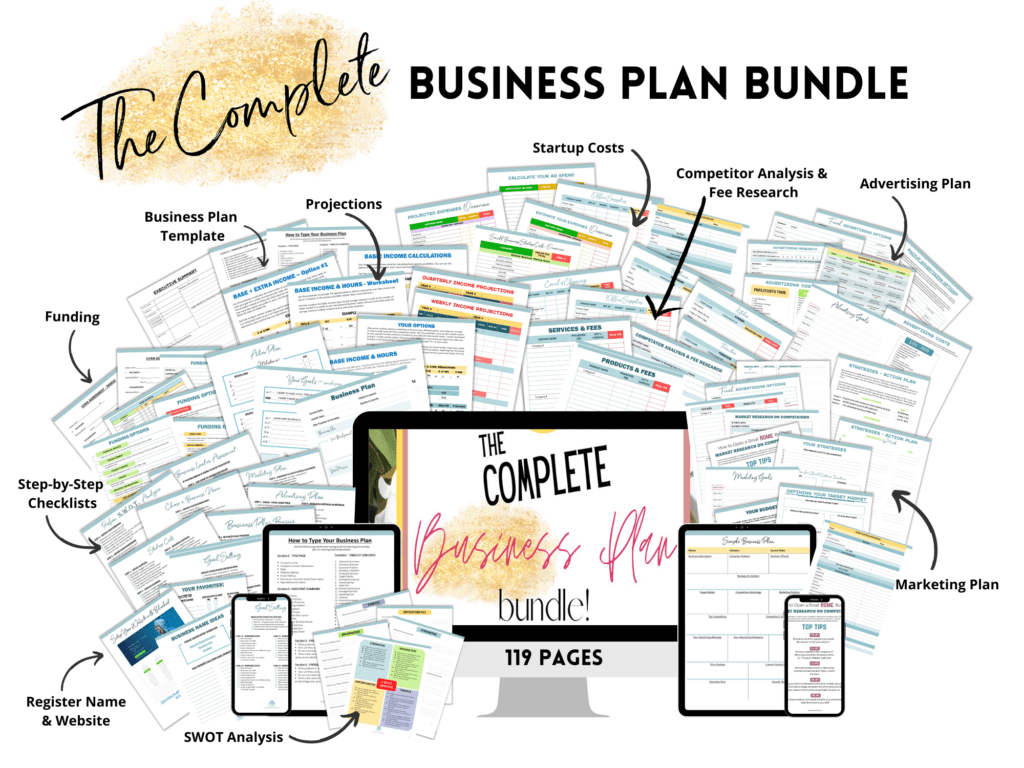

If you’re ready to create your plan but are overwhelmed and lost with where to start, checkout my Complete Business Plan Bundle!

It contains everything you require to create your plan, research, and present it in a professional way for banks and investors.

I’ve even filled out many of the templates for you so you don’t have to! Save time and stress! Simply input what’s specific to your business.

What are the biggest mistakes you can make when preparing a business plan?

- Not being realistic about your projections

- Not researching your competition

- Not completing a SWOT analysis of your business

- Not researching and defining your target audience

- Over complication your business plan

What are the disadvantages of a business plan?

The main disadvantage of having a business plan is that it can be too rigid. You don’t want to overcomplicate your plan to where there is no room for flexibility. Write out all of the necessary aspects of your plan on a basic level and leave room to make changes as needed. The danger of overcomplicating your business plan is that some people get lost in the planning and don’t move forward with their plan as fast as they could or worse, they have trouble implementing their plan. This happens when the plan is so complicated, they don’t know where to start. So they just don’t.

Business Plan Advantage!

One huge advance of having a business plan in place is the policies and procedures part of your plan. You may not think this is necessary, but it is very important to have policies and procedures in place for different situations that will eventually arise so that each customer is treated in the same professional manner. This continuity in business is so important! You don’t know who knows who and you don’t want to treat the same situation with 2 different people completely differently and later find out they are friends and trash talk your business to everyone they know because one of the friends was treated differently from the other.

This makes you look unprofessional. This is why continuity is so important. You need policies and procedures. Don’t believe me? Take a look at every business out there. Big or small. Box store or local business. If you go to the website of any, you’ll notice they have their policies right on their site. In my business for example, if a client doesn’t show up for an appointment with me, how am I to handle it? There is no receptionist or manager to deal with the situation, so it’s up to me. What do I do? Do I call them? What do I say? Should I charge them? What if they yell at me? What if they refuse to pay?

These questions are all answered in my business plan in my policies and procedures section for this particular scenario and when these situations occur, I know exactly how to handle the situation, every single time! It also allows me to treat all of my clients equally, professionally, and with respect.

How do you present a business plan proposal to investors?

When presenting a proposal to a potential investor, make sure your plan is organized, typed up, printed, and presented in a folder that the investor can flip through while you make your pitch. Share a small amount of your personal background with them so they know that you have experience in the field of business you want to open. Move swiftly but clearly through your plan.

Make sure you speak normally and don’t rush (it can make you look nervous). Explain the different aspects of your plan but don’t get off-topic. Keep your sections short and to the point. Also, ensure you go over the most important aspects first while there is time in your meeting. You don’t want to run out of time during your appointment. For example, it is more important for your potential investor to hear about your quarterly income projections than it is for them to hear about policies and procedures (as this is more for yourself to help you operate your business after opening as you will be working by yourself).

Why do business plans fail?

Business plans fail when the business owner fails to implement and follow the plan. They can also have issues when they fail to make updates to their plan. Some business plans fail because the idea was not a profitable idea. Meaning there is no market for it, no demand.

How can a business avoid failure?

You can avoid failure simply by thinking through your business idea first and foremost. Make sure there is a demand for your product or service. Think through the different aspects carefully, be realistic, and actually implementing your plan can help you avoid failure. Also, ensure you keep an eye on your competitors and what they are doing to help inspire changes in your own business after being open for a little while. Another very important thing is not to overspend!

For example, I know some Aestheticians who can’t help but order products from their suppliers for themselves in excess or they continuously dip into their products that were purchased for their business. You have an expense plan for a reason, and it’s for your business, not for you! Overspending like this whether it’s an Aesthetics business or otherwise will put you in debt faster than you realize is possible. Usually, when people overspend, they aren’t following their business plan and what happens is they put themselves out of business before they realize what happened! So don’t do it!

Putting your business plan into action

Once your business plan is finished, you can begin the process of setting up and opening your business. Whether you are opening a large business or a small home business like I have, your business plan will help keep you on track as you move through the setup and opening process and will continue to keep you on track as you begin to operate your business day today. Don’t forget to be flexible, update your plan when needed, and follow your financial plan as closely as possible.

Now that you know how to create a thorough business plan and understand the different parts of the plan, you are on your way to having a successful business!

Want help creating your plan? Book a free 30 minute discovery call with Alexis to find out how she can help!

Click the image below to schedule your call today.

No Comments